|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding the 15 Year Mortgage Calculator for Better Financial PlanningThe 15 year mortgage calculator is an essential tool for homeowners looking to pay off their home loan faster. This calculator helps you determine monthly payments, interest savings, and the overall impact on your financial situation. How the 15 Year Mortgage Calculator WorksInput DetailsTo use the calculator, you need to input certain details such as the loan amount, interest rate, and loan term. These variables are critical in calculating your monthly payments and total interest paid over the life of the loan. Understanding the OutputThe calculator provides a breakdown of your monthly payment and the total interest you will pay over the 15 years. This information can be crucial when deciding whether to opt for a shorter mortgage term. Benefits of a 15 Year Mortgage

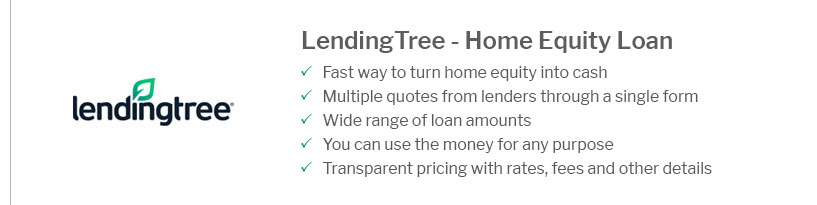

Considerations Before Opting for a 15 Year MortgageHigher Monthly PaymentsOne of the main drawbacks of a 15 year mortgage is the higher monthly payment. It's important to ensure that this payment fits comfortably within your budget. Comparison with Other OptionsConsider comparing will refinance rates go lower to see if refinancing might offer more favorable terms. Using the Calculator for RefinancingIf you're considering refinancing, the 15 year mortgage calculator can help you evaluate potential home refinance offers. By adjusting the loan term and interest rate, you can see how refinancing impacts your finances. Frequently Asked Questions

https://www.mortgagecalculator.org/calcs/15-year.php

Current Mountain View Fifteen Year Mortgage Rates. Here is a table listing current Mountain View 15-year fixed rates. ... * Points are equal to 1% ... https://www.nerdwallet.com/article/mortgages/15-or-30-year-mortgage-calculator

A 15-year mortgage is designed to be paid off over 15 years. A 30-year mortgage is structured to be paid in full, or amortized, in 30 years. The interest rate ... https://www.peapackprivate.com/calculator/mortgage-compare

Marginal tax rate. This is your combined state and federal tax rate. This is used to calculate possible income tax savings by deducting your mortgage interest.

|

|---|